The Hidden Costs of Fleet Safety Risks

Operating a fleet is fraught with risk. Collisions, incidents and compliance violations are obvious hazards, but the real cost of poor safety goes far beyond the repair invoice. Studies show that the hidden costs of a collision can be 4 – 32 times the price of repairing the vehicle[1] and may even reach 8 – 53 times the insurer’s payout when deductibles, lost productivity and reputational harm are considered[2]. In other words, the financial iceberg below the surface dwarfs the “bent‑metal” cost visible above the water. This article explores those hidden costs and explains why proactive safety management is an investment, not an expense.

Visible vs hidden costs

When a vehicle is involved in a crash, the bill for bodywork or a replacement panel is easy to measure. However, researchers note that vehicle damage often accounts for only a fraction of the true cost[1]. A U.K. fleet safety white paper summarized a range of additional expenses – vehicle recovery and storage, downtime, reduced resale value, loss of driver expertise, injuries to the driver and others, third‑party property damage, missed sales, damaged stock, reputational harm and management time[1]. Fleet News put it succinctly: hidden costs such as administration, downtime, hiring replacement drivers and lost work time can be up to four times the cost of the damaged vehicle[3].

Summary of key hidden cost categories and multipliers:

These figures illustrate why the aftermath of an incident can be devastating for a company’s bottom line. The costs accrue from many directions, including productivity losses, legal exposure and damage to reputation, and they grow exponentially when injuries or fatalities are involved.

Financial impact of accidents

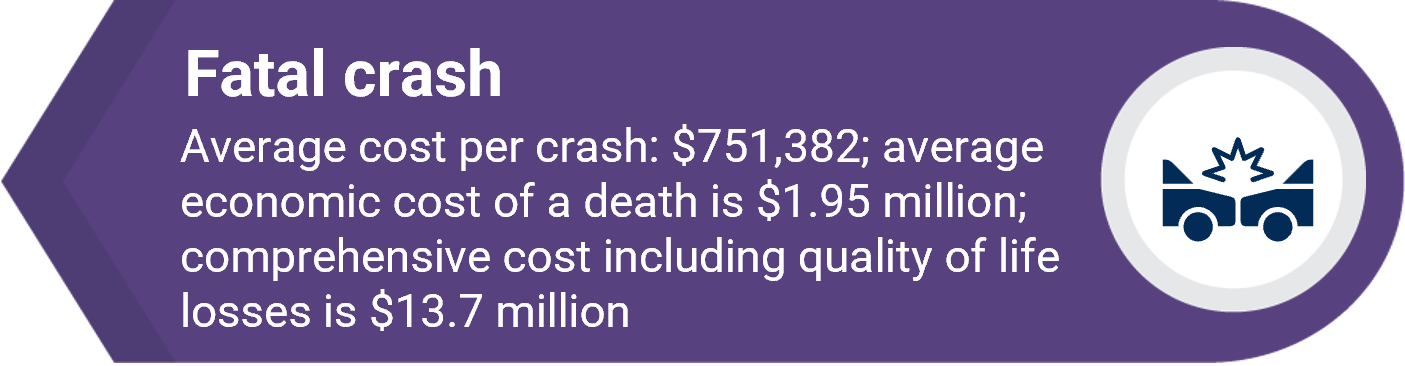

The Network for Employers for Traffic Safety (NETS) found that a fleet of 1,000 vehicles spends an average of $1.1 million per year just on property‑damage losses. Their 2019 study pegged the average cost of a non‑fatal injury crash at $75,176, while a fatal crash can cost $751,382, and even a crash that only causes property damage costs around $5,483[8]. These figures align with the National Safety Council’s estimate that the average economic cost of a death from a motor‑vehicle crash in 2023 was $1.95 million, with disabling injuries costing $167,000 and property damage accidents costing $6,300 per vehicle[4].

Beyond these direct costs, insurers may raise premiums after a claim. Cardata notes that fleet insurance typically costs $1,200 – $3,000 per vehicle each year[6] and that insurers often reward companies using telematics and driver‑training programs with lower rates[6]. Conversely, a poor collision record can make insurance unaffordable; Brightmile suggests that the difference in premium between a fleet with a good record and a bad record can exceed £300 per vehicle[2].

Beyond the numbers – operational disruption and human factors

Accidents reverberate through every part of the business. Platform Science’s analysis of vehicle downtime points to hidden costs such as unmet customer expectations, late deliveries erode customer satisfaction and jeopardize repeat business[5]. Downtime also impacts driver morale; repeated breakdowns reduce drivers’ confidence in their equipment, disrupt their earning potential and hurt work‑life balance[5]. There are safety and compliance risks too: emergency rerouting or calling in replacement drivers can lead to hours‑of‑service violations and increased crash risk[5]. Finally, downtime creates a ripple effect across operations; back‑office staff must reschedule loads and maintenance teams may postpone preventive work, which in turn increases the risk of further unplanned downtime[5].

These operational disruptions are exacerbated when injuries occur. Lost productivity is not limited to the injured driver; other employees may need to cover shifts, managers spend time on investigations and legal matters, and recruiting and training replacement drivers adds further expense.

Legal liability and compliance risk

Regulatory compliance is not optional. In the United States, OSHA penalties for serious violations rose sharply in 2016 and by 2018 stood at $12,934 per violation for serious offences and $129,336 for willful or repeated offences[7]. A court ruling in 2018 allowed OSHA to look back more than five years to identify repeat violations, potentially multiplying penalties[7]. The Checker warns that indirect costs – criminal liability, civil claims, increased premiums, business disruption and negative press can be 300 -1,000% higher than the fines themselves[7]. Fleet managers must also consider industry‑specific regulations such as the Federal Motor Carrier Safety Administration (FMCSA) rules on driver hours and vehicle inspections; violations can trigger audits, out‑of‑service orders and costly downtime.

Liability payouts can be staggering when negligence is proven. Brightmile notes that the average cost of a loss related to a fleet vehicle accident in the USA is about $70,000 and cites a record employer payout of $21.6 million for a fatality caused by a distracted company driver[2]. These cases highlight the existential risk posed by unsafe driving behavior.

Reputational damage and customer relationships

Reputation is an intangible asset built over years. A single high‑profile crash can erode customer trust overnight. The TTC Group white paper lists damage to business reputation among the hidden costs of a collision[1]. Negative headlines or viral social‑media posts about unsafe company drivers can deter potential clients and make it harder to win contracts. In a competitive market, customers increasingly favor suppliers that can demonstrate strong safety practices and compliance with regulations.

Poor safety practices also affect employee recruitment and retention. Platform Science warns that ongoing downtime and unsafe equipment erode driver confidence and morale[5]. Skilled drivers are in high demand, and a reputation for unsafe vehicles or lax safety culture will push them to seek employment elsewhere, increasing recruitment costs and disrupting operations.

Strategies to Control & Reduce Hidden Costs

The good news? These costs are not inevitable. Forward‑thinking fleets are already reducing exposure by embracing data‑driven safety and a culture of prevention:

- Telematics and driver‑monitoring technology – These tools enable real‑time monitoring of driver behavior, help enforce hours‑of‑service rules and support early intervention when risky driving is detected. Insurers often offer discounts to fleets that deploy telematics[6].

- Continuous driver training and coaching – Regular training reduces accident risks and helps drivers adopt safer practices[6]. Gamified coaching apps (such as those offered by Brightmile) can motivate drivers through feedback and rewards.

- Preventive maintenance – Keeping vehicles in good repair reduces breakdowns, supports compliance and protects drivers. Integrated digital vehicle inspection reports and predictive maintenance tools reduce unplanned downtime[5].

- Comprehensive safety policies – Documented policies covering driver qualifications, fatigue management, distracted‑driving rules and incident reporting demonstrate diligence and help defend against liability claims.

- Leadership commitment and culture – Safety must be championed at the highest levels. The TTC Group white paper emphasizes that robust driver risk programs not only reduce collision costs but also reinforce a broader safety culture across the business[1].

Conclusion

Fleet‑related collisions and compliance breaches carry costs that far exceed the price of repairing a vehicle. Hidden expenses like lost productivity, driver downtime, insurance hikes, regulatory penalties and reputational harm can multiply the visible costs many times over[1][2]. In extreme cases, the real cost of a crash is tens of times the insurer’s payout[2]. Employers can’t afford to ignore these risks. By investing in technology, training and a culture of safety, fleets not only protect their drivers and the public but also safeguard profitability and brand integrity.

Rhythm specializes in solutions that help fleets turn safety into a competitive advantage. Our team can help you implement telematics, training, and compliance tools that reduce hidden costs and keep your fleet running smoothly. To learn more, contact us today.

References

- TTC Whitepaper: Fleet and Driver Risk Management

- The Hidden Costs of Unsafe Driving – and How Companies Can Manage Them

- Fleet News Digital Issue: FLE68.pdf_MERGE.pdf

- Guide to Calculating Injury Costs 2023 – Injury Facts

- The Hidden Costs of Vehicle Downtime and How to Avoid Them – Platform Science

- Fleet Insurance Costs: What It Costs Businesses to Insure Their Company Cars – Cardata

- What’s the Cost of OSHA Non-Compliance? – The Checker

- Cost of Motor Vehicle Crashes to Employers – 2019 – NETS