From Chaos to Command: Fleet Risk Reimagined

Connect fragmented fleet data and empower teams to act faster, reduce costs, and ensure compliance.

Complexities of Fleet Risk Management

High-Severity Risk Exposure

Fleet crashes increasingly lead to catastrophic losses - driven by distracted driving, fatigue, and nuclear verdicts that threaten your organization’s insurability.

Fragmented Data Across Systems

MVRs, telematics, claims, training records, and compliance data are scattered across platforms—limiting visibility and delaying action when it matters most.

Driver Behavior & Fatigue

Organizations struggle to detect unsafe driving behaviors early or provide timely coaching before an incident escalates.

Insurance Market Pressure

Underwriter scrutiny is rising. Organizations must prove defensibility, reduce frequency, and control severity to remain insurable and avoid excessive deductibles.

Making Fleet Risks Easy to Manage

Connected Driver Risk Intelligence

Utilize advanced artificial intelligence to analyze vast datasets and detect early warning signs of potential risks, enabling organizations to respond swiftly and proactively. By identifying emerging threats and trends, AI empowers decision-makers to take preventative actions, minimizing disruptions and safeguarding long-term success.

Real-Time Monitoring and Reporting

Continuously track workforce compliance, safety, and engagement metrics in real-time, ensuring that key performance indicators are consistently met. This instant access to data allows organizations to address issues promptly, enhance operational efficiency, and maintain a safe and productive work environment.

Compliance and Training Management

Streamline the process of tracking and managing employee training and compliance requirements, ensuring adherence to industry regulations and company policies. By centralizing training schedules, certifications, and compliance audits, organizations can minimize risk and enhance overall workforce effectiveness.

Integrated Suite of Fleet Risks Management

Fleet Management

Fleet Management

Track vehicle compliance, inspections, and maintenance schedules to reduce downtime and ensure fleet readiness.

Driver 360

Driver 360

Gain a comprehensive view of each driver’s risk profile-combining behavior, compliance, incident, and coaching data.

Fleet Integration

Fleet Integration

Connect data across telematics, MVRs, HR systems, and TPA platforms for seamless visibility and decision-making.

Telematics

Telematics

Monitor speeding, harsh braking, distracted driving, and fatigue with live behavior data to trigger real-time interventions.

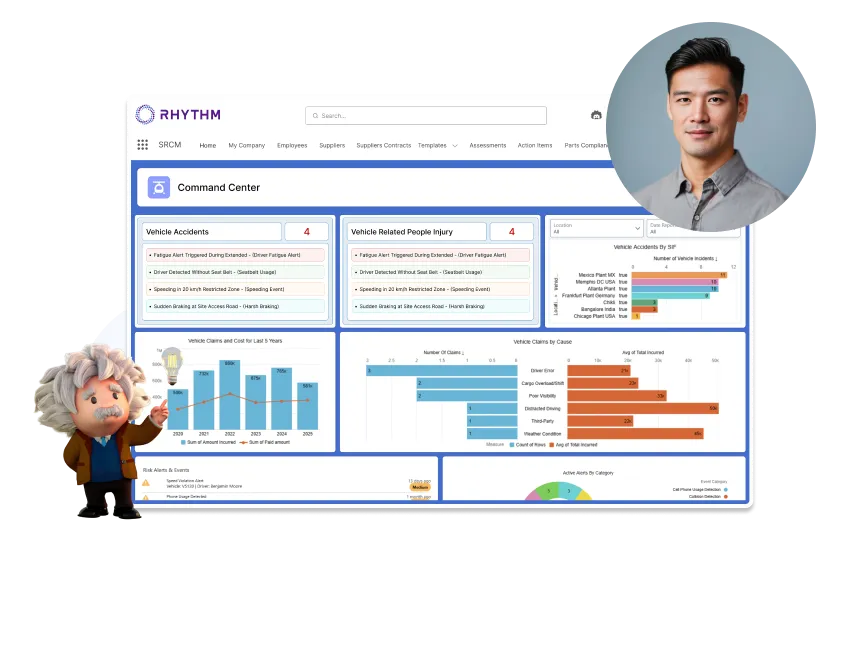

Fleet Command Center

Fleet Command Center

Visualize safety alerts, violations, tasks, and open claims in one shared dashboard for Risk, Safety, and Ops teams.

Claims & TPA Integration

Claims & TPA Integration

Streamline post-incident workflows by integrating claims data and TPA feeds to reduce settlement time and increase insurer confidence.

Get a Consolidated View of Your Fleet Risks

Unified View of Fleet Risk

Break down data silos across risk, safety, and insurance to act faster and reduce blind spots.

Protect Insurability

Demonstrate proactive risk controls and behavioral improvement to lower premiums and retain favorable terms.

Prevent Incidents, Lower Claims

Use AI to identify high-risk drivers and intervene before crashes occur—reducing both frequency and cost.

Maintain Compliance and Reliability

Track fleet health and regulatory status in real-time to ensure your vehicles and drivers are always road-ready.

What You Can Expect !

Reduction in Preventable Incidents

Driver behavior insights and coaching reduce crash frequency and severity.

Reduction in Unscheduled Maintenance Downtime

Predictive service tracking helps avoid costly mechanical failures.

Reduction in Fleet Insurance Claims

Integrated data improves documentation, lowers claim values, and supports favorable underwriting.

Why Rhythm ?

Trusted Partner with a Customer-First Approach

Rhythm prioritizes building long-term partnerships with its clients, focusing on understanding their unique challenges and goals. With a customer-centric mindset, the company ensures personalized support, timely responses, and continuous collaboration to drive success.

Proven Expertise and Industry Leadership

Rhythm’s team comprises industry veterans and experts who bring years of experience in risk management and innovative thinking. This expertise positions Rhythm as a trusted leader, capable of guiding companies through complex risk landscapes with confidence and clarity.

Commitment to Innovation and Excellence

Rhythm is driven by a culture of continuous improvement and innovation. By staying ahead of industry trends and investing in cutting-edge technologies, the company ensures its solutions and services are always at the forefront of risk management excellence.